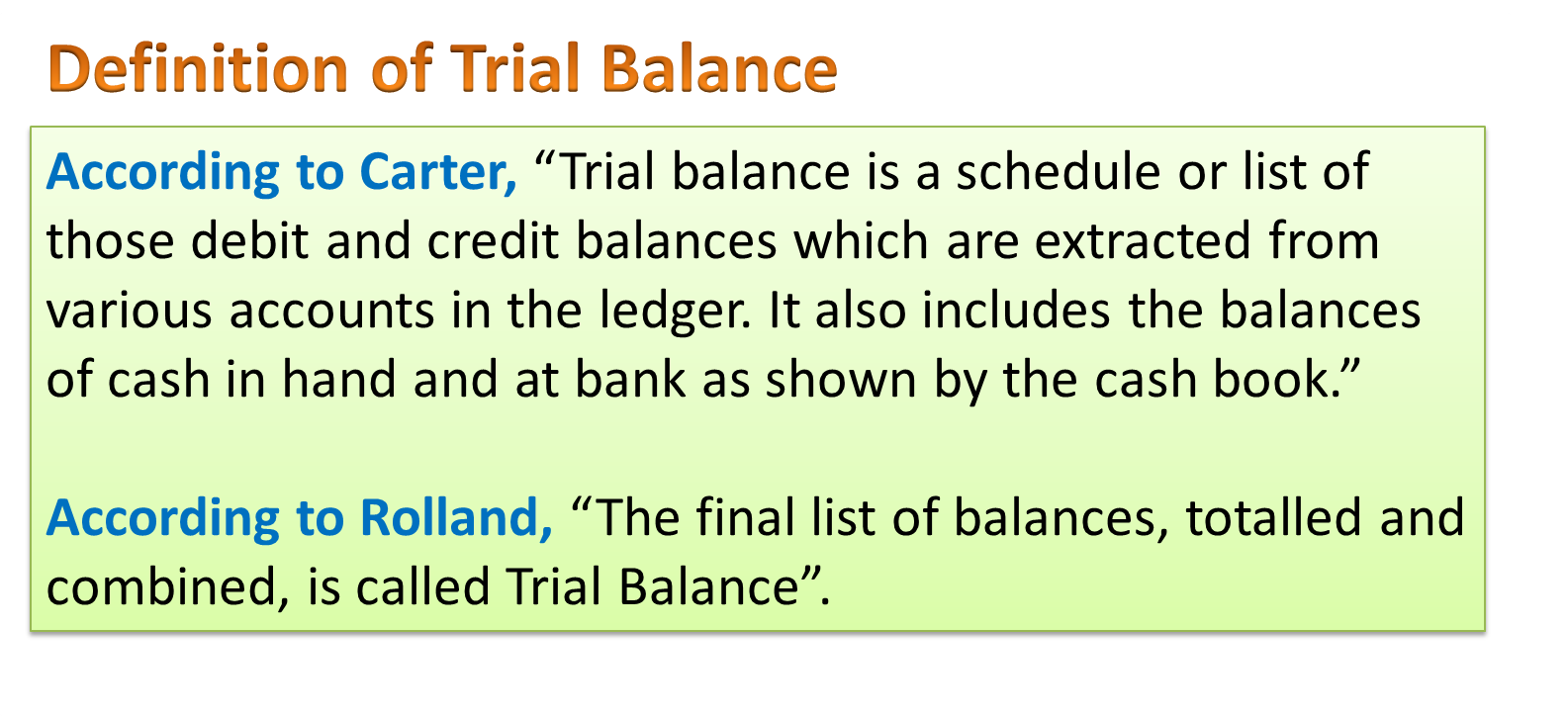

Trial balance is a statement which takes into account all the debit and credit balances from the ledger accounts. It is prepared in order to verify whether the balance of debit side is same as that of the credit side. Trial balance can also be defined as a statement consisting of balances of different ledger accounts on a specific date. When both the sides of trial balance tally it means that books of accounts are accurate.

The following are the objectives of trial balance.

- Trial balance is one of the methods/techniques to assure that the books of account are being scientifically maintained according to double entry bookkeeping system.

- It helps to summarize all the ledger accounts at one place.

- It serves as a method/technique to identify the mistakes which are done by the accountants while recording the transactions in j oumaL1subsidiary books and ledger postings.

- It serves as a foundation in preparing the Trading and Profit and Loss account and Balance Sheet (i.e., final accounts).

Features of Trial Balance

The following are the features of trial balance.

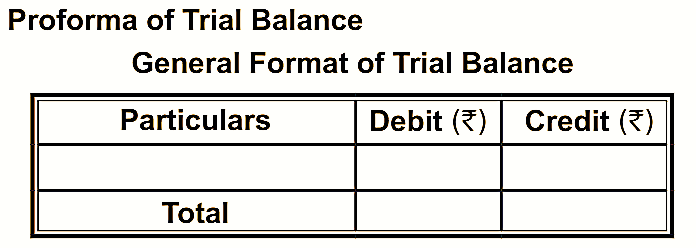

- It is a statement prepared in a tabular form.

- Trial balance is a statement of closing balance but is not an account.

- It is prepared to verify the arithmetical accuracy.

- Preparation of trial balance leads to the preparation of final accounts.

Limitations of Trial Balance

The accountants must take into consideration. the following limitations while maintaining proper accounts.

- Trial balance alone cannot be regarded as the main factor for achieving the arithmetic accuracy of the account books. Quite a few times inspite of there being a balanced trial balance, the accountant may commit mistakes or errors in trial balance. which are not being shown by balances. Even then the trial balance would be balanced with few hidden errors.

- Trial balance is useful only for those finns that implement double-entry bookkeeping. The small firms which do not implement double-entry bookkeeping cannot prepare a trial balance.

- The correct trial balance would show the correct financial position of the firm. The trial balance with mistakes or errors would also result in mistakes or errors in the financial statement which would therefore not show the true and fair position of the firm.

Methods of Preparing Trial Balance

Trial balance can be prepared by using three different methods. Under all the three methods. the total of debit and credit columns should be equal. The three methods used for preparing trial balance are as follows.

- Balance method

- Total method

- Total and balance method.

Balance Method

The trial balance is basically prepared by taking into consideration balances of the ledger accounts. All the ledger accounts have a debit and credit side which are balanced at the end of a particular time period. In case, when the total of the debit side of an account is more than the total of the credit side then that balance is called as debit balance and it appears on the debit column of time trial balance. Similarly, in case when the credit side of an account is more than its debit side. it appears on the credit side of trial balance and is known as credit balance. In trial balance. the total of debit and credit side should be equal.

Total Method

Under this method, total of the debit side is written in the debit column and the total of credit side is written in the credit column of the trial balance. The balance of debit and credit side should be equal. If in case it is not equal then it indicates that there exists few errors which needs to be identified and corrected.

Total and Balance Method

Under this method. the balance and total method of the trial balance are shown in the same trial balance. This method divides/segregates the amount column between total and balance methods. Both the methods have two columns of debit and credit. However, under each method the total of debit and credit side should be equal. Both the methods would have totals but the total of debit and credit side must be equal.