Ratio analysis is a very important tool for financial analysis. It is the process of establishing a significant relationship between the items of financial statements to provide a meaningful understanding of the performance and financial position of a firm.

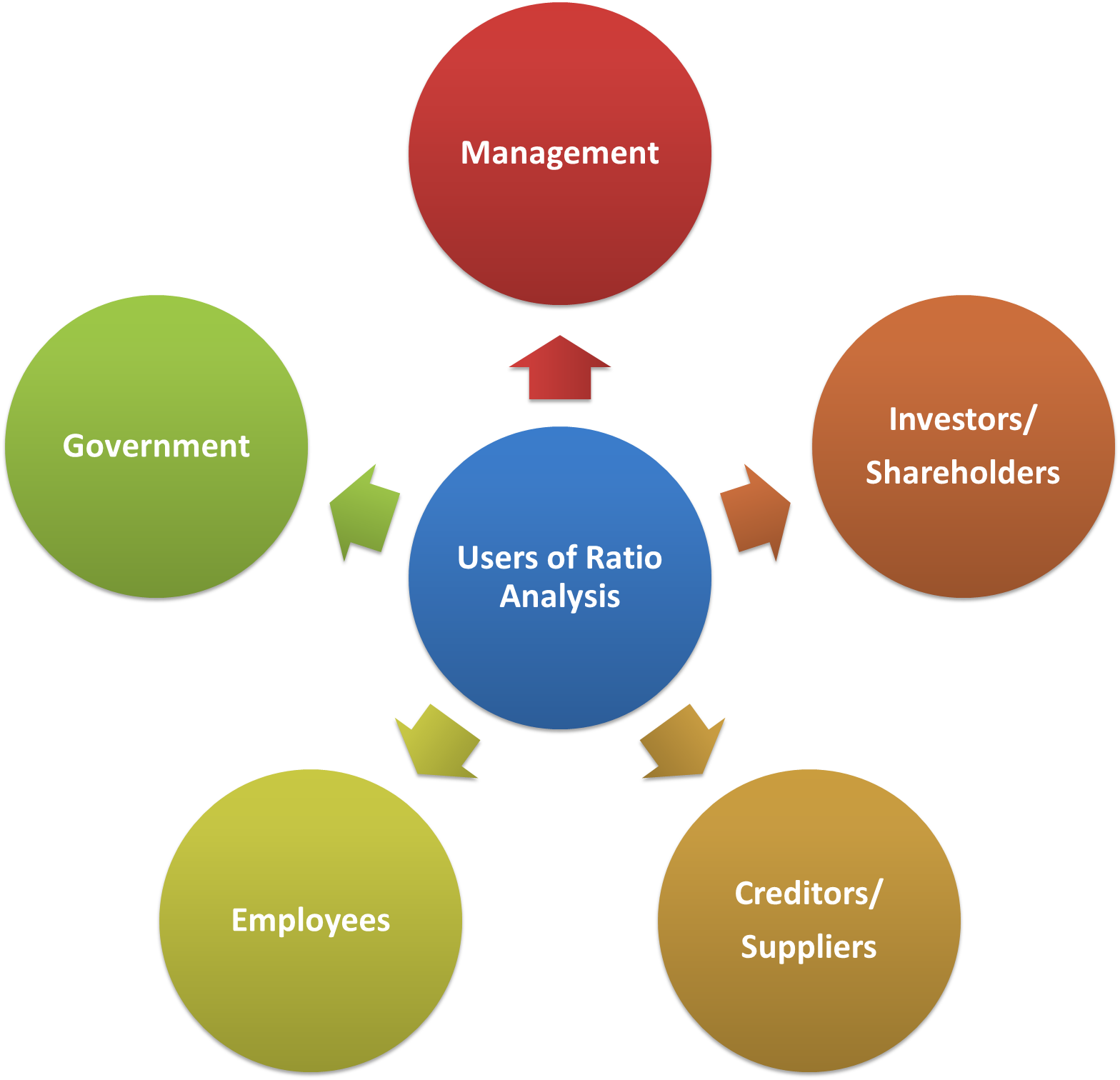

Users of Ratio Analysis

Ratio analysis plays a significant role in ascertaining the financial performance of concern. The following are the various users of ratio analysis.

(i) Management

Ratio analysis helps management to reap many managerial uses from it. They are.

- Ratio analysis helps management assess the financial position of the firm and make necessary decisions from the information available in the financial statement.

- It facilitates financial forecasting and financial planning.

- It helps in communicating the financial strength and weakness of a firm in a more easy and understandable form.

- It helps in the coordination of activities which is the most important functions of business management.

- It facilitates in effective control of the business by revealing the loop holes in it.

- Ratio analysis also serves many other purposes to the management by becoming an essential part in budgetary control and standard costing.

(ii) Investors/Shareholders

Ratio analysis helps investors or a shareholder to assess the financial position of the concern in which he is going to invest It warns him in making up his mind whether the present financial position of the concern warrants him for further investment or not The calculation of various ratios help him to do this.

(iii) Creditors/Suppliers

Ratio analysis helps the creditors or suppliers who extend short-term credit to the concern: to know whether the financial position of the concern warrants their payment at a specified time or not.

(iv) Employees

Ratio analysis also helps the employees who are interested in knowing the financial position of the concern. Various profitability ratios facilitate them to know for the increase of their wages and other benefits.

(v) Government

Ratio analysis aids the government in assessing the financial health of different industries and preparing its future policies. With all the utilities to various users, ratio analysis serves as a powerful tool for ascertaining the financial position of a concern.

Advantages of Ratio Analysis

Following are the advantages of ratio analysis:

- Ratio analysis simplifies the understanding of financial statements.

- Ratio bring out the inter relationship among various financial figures and bring to light their financial significance and it is a device to analyze and interpret the financial health of the enterprise.

- Ratios contribute significantly towards effective planning and forecasting.

- Ratios facilitate inter-firm and intra-firm comparisons.

- Ratios serve as effective control tools.

- Ratios cater to the particular information need of a particular person.

Limitations of Ratio Analysis

Following are the limitations of ratio analysis.

- Ratio may not prove to be the ideal tool for interfirm comparisons. When two firms adopt different accounting policies.

- A study of ratios in isolating, without studying the actual figures may lead to wrong conclusions.

- Ratios can be calculated based on the data. If the original data is not reliable: then ratios will be misleading.

- Ratio analysis suffers from lack of consistency.

- In the absence of well accepted standards: interpretation of ratios become subjective.

- Ratios fail to reflect the impact of price level changes, and hence can be misleading.

- Ratios are only tools of quantitative analysis and fail to take into account the qualitative aspects of a business.

- Ratios are based on past data and hence cannot be reliable guide to future performance.

- Ratios are volatile and can be influenced by a single transaction with extreme value.

- Ratios are only indicators. They need a proper analysis by capable management, they are only the means, and not an end, in the interpretation of financial statements